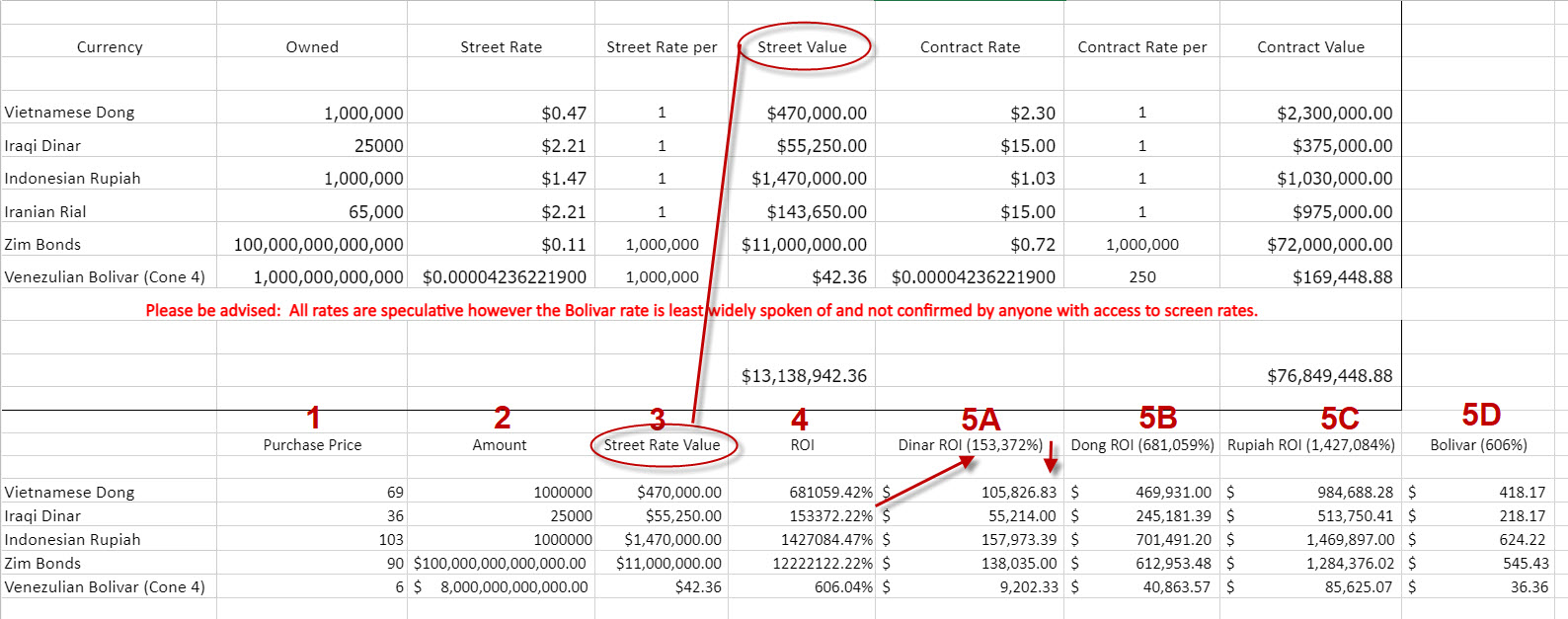

Consider the following chart: (click to open in new tab)

Here goes the logic…

Column 1: Purchase Price for each currency amount in Column 2

Column 2: Quantity of Currency purchased for amount in Column 1

Column 3: Street Rate Value of purchased currency from Column 1

Column 4: ROI Based of each Currency

Columns 5A: Value of each currency amount using Dinar ROI.

Columns 5B: Value of each currency amount using Dong ROI.

Columns 5A: Value of each currency amount using Rupiah ROI.

Columns 5A: Value of each currency amount using Bolivar ROI.

I excluded Rial because I don’t own any and don’t have the purchase value and ZIm for it’s ROI because it’s a bond. However I calculated the Value for Zim to illustrate values using other currency’s ROI.

And here’s how to apply the logic…

Choose a currency in which you have the most confidence of the rate. Let’s use the Dinar since general consensus is it will “Reinstate” instead of “Revalue”. So a street rate of $2.21 would yield an ROI of 153,372%. So look down column 4A and to see the equivalent ROI for each respective currency using the Dinar ROI.

At that ROI Percentage…

For every:

1 Million Dong

1 Million Rupiah

100 Trillion Zim

8 Trillion Bolivar

You’d receive approximately:

$105,826

$157,973

$138,035

$ 9,202

How do your expectations align with these numbers?

I’m not suggesting this is how it will work (I have no idea), I’m merely presenting this calculation as one POSSIBILITY.